Private 5G Networks Start Powering Autonomous MiningPrivate 5G Networks Start Powering Autonomous Mining

Nokia’s private 5G solution is enabling autonomous mine clearing technology in Colombia, while Inmarsat is preparing to provide hybrid 5G-satellite services.

October 25, 2021

Autonomous mining using 5G cellular technology and satellite Internet of Things (IoT) services is starting in markets around the world.

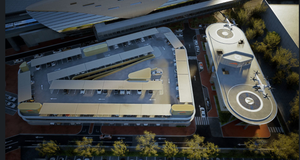

One of Latin America’s first autonomous mining pilots is taking place in Colombia, enabled by an industrial-grade private 5G network from Nokia.

Using cameras and sensors, machines can detonate dynamite in the pit of the mine without direct human supervision.

5G for Connected Mines

In the mines around Colombia’s share of the Andes mountains, there’s a strategic dilemma to be resolved.

On one hand, there’s plenty of untapped economic potential and a sharp need with 27% of Colombia’s citizens living in poverty, according to DANE, the national statistical information provider. Colombia is a major producer of coal and gold and is reportedly looking to ramp up copper output to meet anticipated demand for rechargeable batteries.

As with most deep mining epicenters, however, tragedies in Colombia frequently occur. From 2005 to 2018, there were more than 1,200 emergencies in Colombian mines caused more than 1,000 deaths, according to national safety, rescue and public health experts. The national mining agency says illicit diggers in unsanctioned mines accounted for six in 10 deaths in the first eight months this year.

Connected technology offers a potential solution.

In these early days for private 5G-enabled mines, the spectrum’s multiple frequency bands are a key draw, according to Alejandro Cortes, the firm’s head of enterprise for northern Latin America.

“The pilot has shown to the community how the use of new technology will help on the daily operations of the mine, optimizing productivity and efficiency,” Cortes said.

Operating autonomy underground requires high-definition imagery so that computer vision algorithms can determine different elements in the rock at unfailing accuracy, while ultra-low latency is needed for the controller above ground to adjust the machine’s trajectory, according to Dan Bieler, principal analyst at Forrester.

Similar use cases have already emerged for 5G in verticals such as smart shipping ports, so the technology is largely already to go, Bieler told IoT World Today.

Other telecommunications providers also expect 5G to support deep mining safety and digital efficiency tools. Earlier this month, Mobile TeleSystem (MTS), a Russian mobile operator, began developing a 5G-ready private network at an iron mining and processing plant.

The private enterprise network would support voice and video communication, positioning and video mining, emergency notifications and operational management of the production complex. However, MTS says 5G will come later, and it’s only promising LTE speeds at the start.

Despite some operators choosing to remain with LTE for now, Cortes says the value creation of 5G will center on three major use cases: mobile broadband, low-latency requirements and massive machine-type communications.

“Safety is an absolute priority in a mining environment,” said Cortes.

“A reliable multi-service network with the capability to prioritize mission-critical services will contribute to the enhancement of worker safety and the enablement of other health safety environment community-related use cases,”

“The concept of automation and digitalization should not be misunderstood as a replacement of people but as process of better utilization of personnel, preventing incidents and substantially reducing worker injuries and fatalities.”

In the case of mining, often the private 5G node can run without external internet connectivity, as the main thing is often about providing wireless bandwidth to machinery at sufficient speeds, and without interruption, Bieler said.

Adding wired connections into the deep mine would render intelligent IoT technologies useless, so having 5G to run data transmissions to the private network above ground is essential to operate sensors and video.

Bieler says underground mines are probably one of the clearest enterprise benefits of 5G connected technology.

“There can be significant problems if a mine collapses and the whole community is taken apart. You want to make sure that if you are a mayor of village, you do everything for the people who work in your area.”

“In many cases we are talking about developing countries. But the likes of Rio-Tinto, Anglo-American and their peers are all looking into this, and all for the same reasons.”

Autonomy and private 5G in mines work together, however other mining applications do need to be connected to the external internet, which poses challenges for mines in Colombia’s hinterland.

Satellite Internet of Things (IoT) services could be an option in these cases if the mobile network coverage is patchy. The same private network used to communicate with 5G systems underground could host a satellite terminal for external data transmissions.

For example, a machine-to-machine connectivity service is being rolled out by U.K.-based satellite operator Inmarsat to monitor mining environmental conditions in Chile, farther to the south of Colombia.

“This was previously something that was carried out by human inspection, but with Chile prohibiting movement (due to COVID-19) this was no longer possible,” said Mike Carter, president of enterprise, Inmarsat.

“While Covid-19 necessitated a fix to this situation, it was probably a matter of time until this function became automated.”

Mining IoT is a monetization opportunity for the new wave of cheaper spacecraft dispatched into low earth orbits (LEO), closer to the Earth’s surface, which reduce latency and costs compared to more distant orbits historically used for communications.

Companies such as OneWeb or SpaceX have tried to revolutionize this space, while others like Inmarsat are looking to mature the market using services that combine LEO satellites with terrestrial IoT coverage.

In its forthcoming Orchestra program, Inmarsat plans to fuse its existing spacecraft deployments with a constellation of 150 to 175 LEO satellites to provide stronger coverage in high demand areas.

Terrestrial 5G would also be available through to Orchestra to augment satellite connectivity at specific hotspots, such as ports, airline hubs, straits and sea canals.

“Increasingly, we are seeing hybrid connectivity methodologies being used to respond to the world’s connectivity challenges,” said Carter.

“Satellite will play an increasingly important role in supporting cellular 5G connectivity in places where there is no cellular signal, or where there is contended or damaged infrastructure.”

“The growth of 5G and IoT will be symbiotic, but so will the use of satellite within that growth trajectory, as part of a hybrid connectivity mix.”

About the Author

You May Also Like