Flying Taxi Company Files for $90M IPOFlying Taxi Company Files for $90M IPO

The offering price is $6 per share with the aim of continuing the funding of the development of the Vertical electric aerial vehicle

Vertical Aerospace, an eVTOL (electric vertical takeoff and landing) vehicle maker, has priced a public offering at $90 million.

The offering price is $6 per share with the aim of continuing the funding of the development of the Vertical VX4 electric aerial vehicle (EAV).

“Vertical intends to use the net proceeds from the offering to fund its research and development expenses as Vertical continues to develop the VX4 and its expenditures in the expansion of its testing and certification capacities, as well as for general working capital and other general corporate purposes,” stated the filing with the Securities and Exchange Commission (SEC).

Vertical has conducted the piloted take-off and landing and phase 2 of its flight test program is now underway.

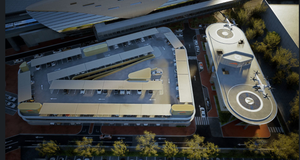

The full-scale VX4 prototype flight tests were conducted at the company’s flight test center at Cotswolds Airport in the U.K. late last year.

For more flying vehicle and other emerging tech news subscribe to our free newsletter!

Tests have moved on to low-speed maneuvers with lift generated by the propellers.

All the other air taxi services in development are working through similar regulatory approval processes.

This was the second of four test phases required by the U.K. Civil Aviation Authority’s (CAA) to receive certification. The third phase involves taking off and landing like a conventional aircraft with lift generated by the wings.

Vertical Aerospace was recently offered a $75 million financing deal from its main creditor.

Mudrick Capital Management, which invested $200 million in the form of convertible senior secured notes in Vertical in 2021, proposed an equity offering to fund the company into 2026, according to an SEC filing.

Vertical said the company has the capital needed for the business to deliver its operational goals over the next 12 months.

This is the latest in the recent financial situation relating to the business of flying vehicles.

German eVTOL jet maker Lilium had announced it was facing insolvency after the company was denied a $54 million loan guarantee from the government of Bavaria.

Lilium ultimately signed an asset purchase agreement with the Mobile Uplift Corporation, allowing the flying taxi company to continue business operations.

The deal with Mobile Uplift, a company set up by a consortium of investors from Europe and North America, gave the new investors the operating assets of the subsidiaries Lilium GmbH and Lilium eAircraft GmbH.

On the other side, flying taxi company Joby Aviation had announced a public offering of common stock aimed at raising $202 million for the EAV maker, which followed a $500 million investment from Toyota.

As to the actual vehicles, Vertical Aerospace is proceeding with its flight test program on the road to certification of its VX4.

Vertical earlier had received a funding commitment of $50 million from Stephen Fitzpatrick, the company founder who stepped down as CEO last year.

Vertical’s partners included Honeywell, which is designing the aircraft control system, and GKN Aerospace, Hanwha, Molicel, Leonardo and Syensqo.

Rolls Royce, an original investor in Vertical, decided to leave the electric flight business and put its advanced electric propulsion systems business up for sale.

The EAV maker is building its flying vehicle to feature more advanced technology and is aiming for certification by the end of 2026. Vertical already has received design organization approval from the CAA.

Read more about:

Flying CarsAbout the Author

You May Also Like