The Value Chain Is Evolving for Connected-Home CompaniesThe Value Chain Is Evolving for Connected-Home Companies

Connected-home companies are going through transformational growing pains from an unexpected source -- smartphone control. How should they adapt?

June 5, 2017

By Cory Sorice

Connected-home companies are going through transformational growing pains. Surprisingly, these growing pains aren’t a result of home automation technical issues, but from a less likely source — smartphone control. This process is a journey most durable-products companies will be forced to consider given the entry of Google, Amazon and Apple, one that reshapes all aspects of a company’s value chain.

Home automation finds a remote control

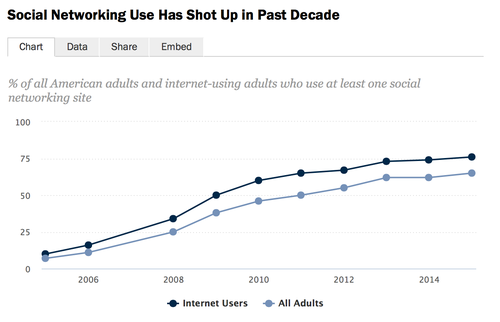

Since its launch in 2007, the iPhone and the ensuing wave of app/platform-enabled phones has created a universal remote control like no other. Consumer interaction with the smartphone started with increased levels of communication, then social sharing, and finally advanced digital + physical combinations.

Six years ago when it was early in the smartphone movement, the fitness products category began its journey of combining a smartphone app with connected durable products (i.e. pedometers, scales and sensors) creating a much easier way to have a quantified self. Like the fitness app sector, durable smart-goods manufacturers began a similar journey — one that necessitated knowing the consumer better and getting introduced to a new world of technologies and suppliers.

Buying is social, product usage Is the conversation

A typical value chain for a manufacturer includes suppliers, its manufacturing base, channel partners and ultimately an end user — the consumer.

While companies have had different strategies for interacting with consumers at the beginning of the purchase process, as well as after the installation, social media has evolved into a new means for consumers to interact with other consumers. It’s an opportunity for the manufacturer to provide meaningful input and receive reports on satisfaction.

Moving from social reviews to connected products

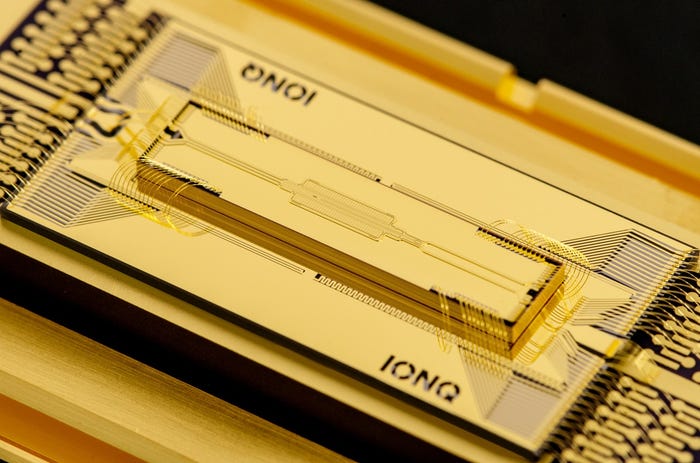

As the smartphone provided a platform to easily download software apps, related radio technologies like Wi-Fi and Bluetooth (BLE) complemented it by providing a global hardware platform for embedding communication technologies being used in the home (Wi-Fi routers), mobile (Wi-Fi and BLE) and even the car.

Durable manufacturers now must consider how to tap into the ability to follow user lifestyle use patterns with improved communication opportunities during sale, installation, device customization and maintenance, including how to best integrate a wider array of suppliers and post-installation partners into the value chain.

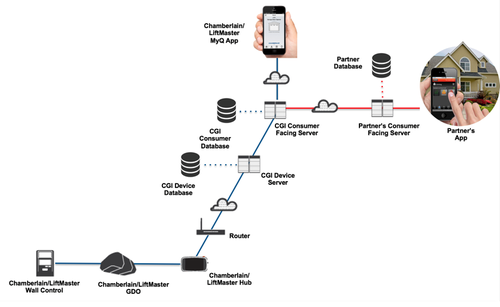

Chamberlain account linking to Connected Partners

Chamberlain adds away-from-home use cases to secure local control

By adding MyQ technology to its durable offering, Chamberlain was able to solve an ancient problem beguiling consumers: forgetting whether or not they closed the garage after leaving home.

Now, with a smartphone and a connected garage door opener, a consumer can use the MyQ app to provide status alerts on the state of the garage door from anywhere, and close their door if they need to. Consumers now do this nearly every day, elevating the garage door as the keystone of the connected home.

Chamberlain found a hidden gem in the data garage doors generate. Consumers increasingly want to know what’s happening at home while they’re away, much like they want more data about their daily activities with fitness tracking. With notifications, consumers can track when other family members and guests come and go. Tens of millions of push notifications go out to MyQ users each week along with a history log of garage activity.

Connected devices are a pathway to a connected home

As durable manufacturers consider new use cases for their own products, they also have to prioritize product development processes for integrating potential new technology inputs to create value for users.

By adding connectivity to its products, a company will also find an array of ecosystem options are available for additional downstream value. While these ecosystems are emergent, they play in important part in providing a consolidated connected-home view for channel partners.

Source: Red Chalk Consulting for CGI

When considering innovation in product, application features and partnerships within ecosystems, a company has to begin to consider the priorities around how to best maximize channel relationships as well as consumer benefits.

The options are increasing, but data will help

Given the dizzying number of new features, partners and potential new products, durable-goods companies have a wide array of options on how to address a market segment.

The need to identify how to create the broadest amount of user value and utility in these early stages is critical. Given technology has rarely been the impediment to home automation success, we all must seek out increasing utility and maximum user benefits, not to mention increased user awareness of key product features.

Ultimately, connected-home companies must undertake a transformational journey that will alter their value chains. By embracing these changes, tapping into available data, and making product and feature development decisions based upon user inputs, it’s possible to successfully complete this journey, and create new downstream revenue streams — and some very happy consumers along the way.

You May Also Like