Connects decision-makers and solutions creators to what's next in quantum computing

Europe, North America Dominate Quantum Vendor Ecosystem: OmdiaEurope, North America Dominate Quantum Vendor Ecosystem: Omdia

It is still too early to pick a qubit modality that will dominate the marketplace

February 23, 2024

Among quantum computer vendors, 76% are headquartered in Europe and North America, according to a new report from research company Omdia, an Enter Quantum partner organization.

Omdia’s latest Quantum Computing Market Tracker report found that advanced economies predominate the quantum computing ecosystem, with quantum technology vendors clustered in North America, Europe, and Asia and Oceania.

A strong connection exists between leading universities and commercial efforts to develop quantum computing technology, like with other deep tech endeavors. Governments in advanced economies are likelier to have established national quantum plans to direct funding and ecosystem coordination efforts toward quantum computing development.

There are 10 quantum computing vendors in China now that Alibaba and Baidu have exited the market. The Chinese government has reportedly committed about $15 billion in quantum technology funding, but its efforts are more focused on quantum communications than quantum computing.

There are rumors that Alibaba and Baidu exited the market as part of a larger effort by the Chinese government to centralize control of quantum technology development.

Hardware Vendors Will Decline

Researchers are still developing new types of qubits and the hardware market is immature, reflected by the nearly 50% share of quantum computing vendors focusing on hardware offerings. Over time, Omdia expects the share of vendors focused on hardware to decline once it becomes clear which qubit type(s) will “win.” Startups founded to develop qubit types that ultimately “lose” expect to be pruned from the market.

By contrast, quantum software services are growing. Since 2016, the share of new vendors focused on software has increased as adopters gained access to cloud-based quantum computing services, could access different qubit types and increasingly wanted third-party software to unify their quantum computing operations.

Consulting firms in the quantum computing market include both boutique firms of academic experts focused on quantum computing and global consulting and system integration giants. The latter typically establish quantum centers of excellence with PhD-level staff.

Services is a long-term niche segment, however. Although most adopters access quantum computing resources through cloud services, vendors focused only on providing cloud access are rare and will likely remain so until the quantum computing market matures significantly. Most services are offered alongside other elements of the technology stack.

Still Too Early to Call a Qubit Winner

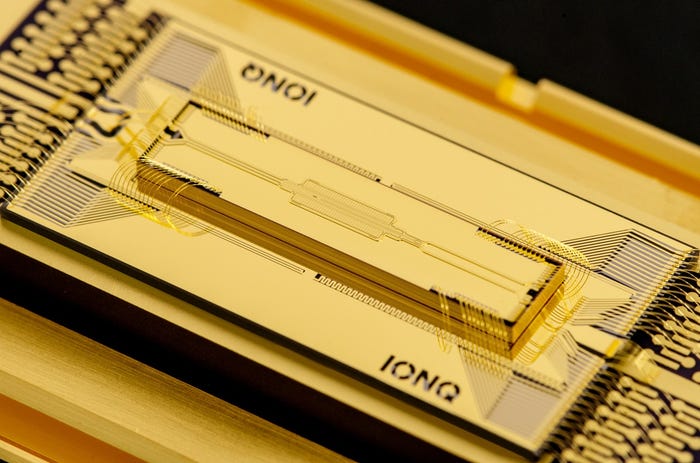

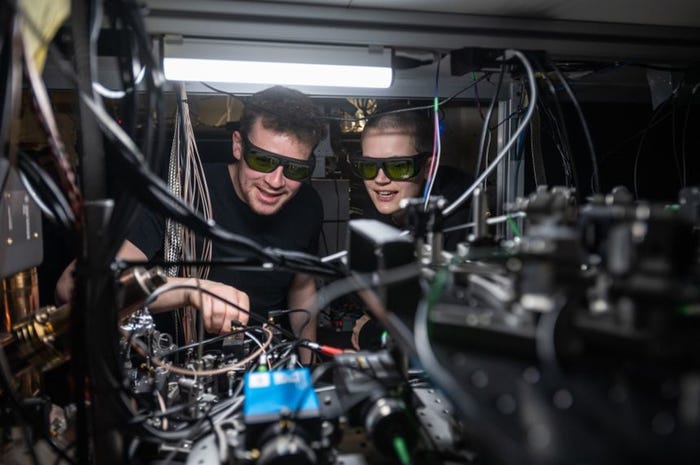

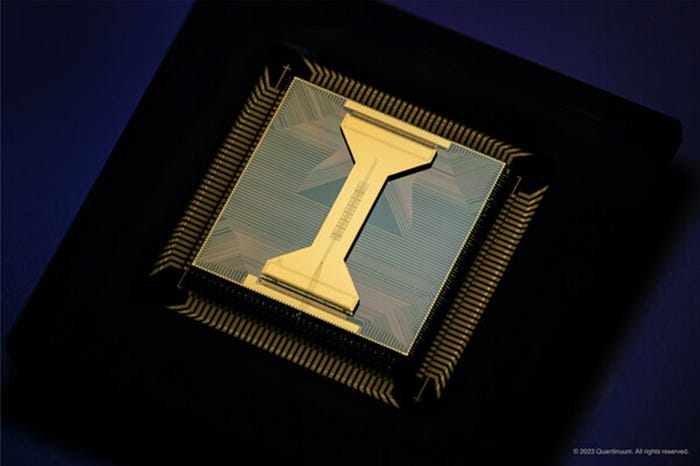

Researchers are still finding new ways to create qubits. Superconducting circuit qubits and trapped ion qubits are relatively more mature than other modalities. Photonics may be a significantly cheaper path to pursue than the other modalities, at least for variations of the technology.

Neutral atom qubits are surging in interest after QuEra Computing demonstrated working logical qubits in the final quarter of 2023 and outlined a believable near-term roadmap at the beginning of 2024 to scale up fault-tolerant operation.

Electron spin-based vendors hope to leverage the trillions of R&D dollars invested in the traditional semiconductor industry over the past 60 years. Topological qubits are at the earliest stage of development and Microsoft Azure Quantum and Nokia Bell Labs are commercially developing them. However, they may prove to be the most robust physical qubit modality in the future.

This is a summary of just a few of the report’s findings. The full Quantum Computing Market Tracker report authored by Omdia chief quantum computing analyst Sam Lucero can be downloaded here.

About the Author

You May Also Like